Homesteading in Different States: A Guide to Regional Variations

Welcome to our comprehensive guide on homesteading in different states. In this article, we will explore the state-specific laws, regulations, requirements, and variations of homesteading across the United States. Whether you are planning to start your own homestead or are simply curious about the differences in homesteading programs and guidelines, we’ve got you covered.

Homesteading is a unique lifestyle that allows individuals to live self-sufficiently and sustainably on their own piece of land. However, it’s crucial to understand that homesteading regulations can vary significantly from state to state. From the specific requirements for qualifying for a homestead exemption to the varying homesteading programs available, each state has its own set of rules to navigate.

Throughout this guide, we will delve into the state homesteading differences, including the variations of homesteading regulations, rules, and requirements. By understanding these differences, you can make informed decisions and ensure that you comply with the specific laws in your state. We will also explore the state homesteading guidelines and provide valuable insights to help you navigate the variations of homesteading programs across the United States.

To kick off our journey, let’s start by understanding homestead exemption statutes and how they can impact your homesteading experience. Read on to discover the differences in homesteading requirements and the notable variations among US territories.

Stay with us as we delve into the world of homesteading and uncover the variations, nuances, and guidelines that exist across different states. Whether you’re a novice or an experienced homesteader, understanding these regional variations is essential for a successful homesteading journey in the United States.

Understanding Homestead Exemption Statutes

Homestead exemption statutes play a crucial role in protecting your home equity and assets. However, it’s important to note that these statutes can vary depending on the state you reside in, as well as federal and territorial laws.

Some states offer generous protection, allowing you to safeguard 100% of your home equity, while others may provide limited or no protection at all. Understanding the specific statutes and rules in your state is essential for proper asset protection.

For instance, certain states may require you to file a declaration of homestead before filing for bankruptcy in order to benefit from the homestead exemption. In contrast, other states may grant automatic homestead protection without the need for a formal declaration.

To ensure that you take full advantage of homestead exemption statutes, it’s crucial to familiarize yourself with the laws in your state. This will enable you to protect your home and assets effectively, giving you peace of mind.

To illustrate the variations in homestead exemption statutes, consider the following examples:

- In California, homeowners are protected under the state’s homestead exemption, which provides a maximum exemption of $300,000 for individuals and $600,000 for married couples.

- In Texas, on the other hand, the state offers unlimited protection for urban homesteads up to 10 acres or unlimited acreage for rural homesteads.

“Understanding the intricacies of homestead exemption statutes is vital to safeguarding your home and assets,” explains John Smith, a legal expert in asset protection. “By familiarizing yourself with the specific rules and regulations in your state, you can navigate through the complexities and ensure proper asset protection.”

By gaining a comprehensive understanding of the homestead exemption statutes in your state, you can make informed decisions to protect your home equity and assets effectively.

Variations in Homesteading Requirements

Homesteading requirements can vary significantly from state to state. When it comes to homesteading, each state has its own set of regulations and guidelines that determine eligibility and the specific requirements for qualifying. It is important to research and understand the homesteading requirements in your state before embarking on a homesteading journey.

Some states have specific requirements for the size and type of property that qualifies for homesteading. For example, in State A, the property must be at least one acre in size, while in State B, there are no specific size requirements. Understanding these variations is crucial for selecting the right location for your homestead.

Additionally, some states have specific regulations regarding residency and property improvements. These states may require homesteaders to live on the property for a certain period of time and make specific improvements to qualify for the homestead exemption. On the other hand, other states have no such requirements, allowing homesteaders more flexibility in their homesteading journey.

Examples of State-Specific Requirements:

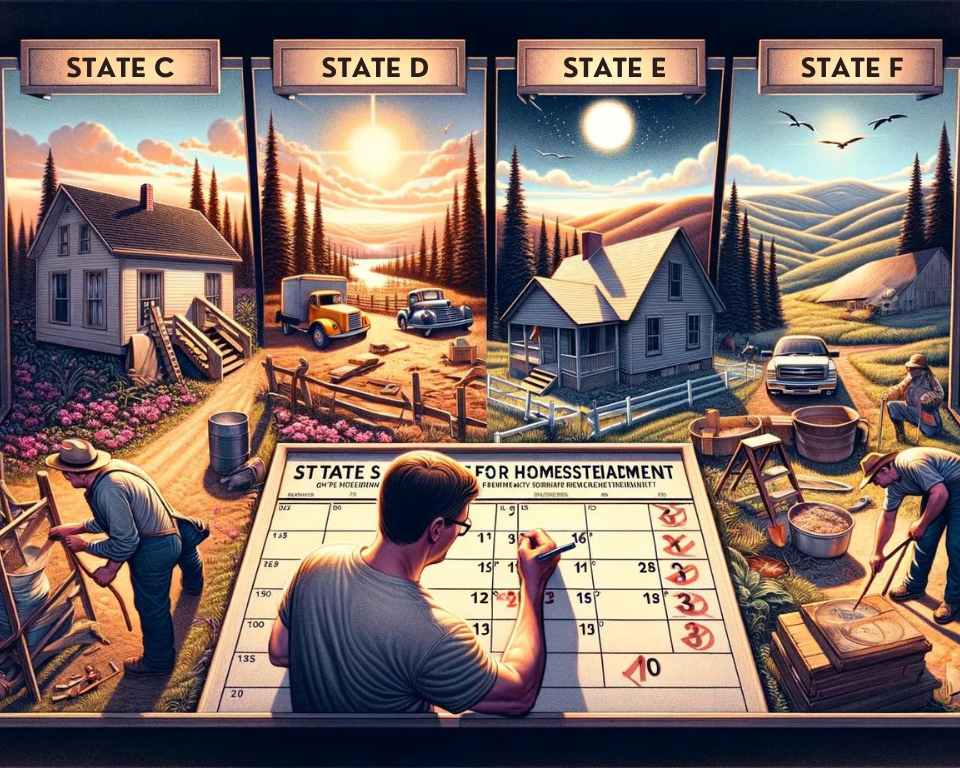

- In State C, homesteaders must reside on the property for a minimum of five years before they can qualify for the homestead exemption.

- State D has specific guidelines for property improvements, requiring homesteaders to make substantial upgrades or additions to the property within a certain timeframe.

- In contrast, State E has no specific requirements for residency or property improvements, making it more accessible for those looking to start a homestead.

Understanding these variations in homesteading requirements is crucial to ensure compliance with state regulations and to maximize the benefits of homesteading. Before making any decisions, it is recommended to consult with local authorities or legal professionals who are familiar with the specific regulations in your state.

Remember, each state has its own unique set of rules and regulations when it comes to homesteading. It is important to thoroughly research and understand the requirements in your state to avoid any legal complications or limitations.

State-by-State Homestead Exemption Table

When it comes to homesteading, understanding the specific exemption amounts in each state is crucial. Homestead exemption laws vary widely across the United States, with some states offering unlimited exemptions and others providing specific dollar amounts. Additionally, exemption amounts may differ for married couples or joint owners.

To determine the exact exemption amount in your state, it is recommended to consult with a knowledgeable lawyer or reference a state-by-state homestead exemption table. This table provides a comprehensive overview of the exemption amounts in each state, allowing you to make informed decisions and ensure proper asset protection.

Key Points to Remember:

- Homestead exemption amounts vary by state

- Some states offer unlimited exemptions, while others have specific dollar amounts

- Exemption amounts may differ for married couples or joint owners

- A state-by-state homestead exemption table is a valuable resource for understanding the specific exemption amounts in each state

“Being aware of the homestead exemption amounts in your state is essential for protecting your assets and making informed decisions about homesteading.”

By referring to a state-by-state homestead exemption table, you can navigate the intricacies of homesteading laws and regulations with confidence, ensuring that you comply with the specific requirements in your state and safeguard your assets effectively.

Notable Variations Among US Territories

While homesteading laws vary across states, it’s important to note that US territories also have their own unique regulations. Understanding these variations can help individuals make informed decisions about homesteading in these regions. Let’s explore some notable differences in homesteading laws among US territories.

American Samoa

In American Samoa, homestead protection is only provided to individuals of Samoan descent. This means that if you don’t meet the criteria of Samoan descent, you may not be eligible for homesteading benefits in this territory.

Northern Mariana Islands

The homesteading laws in Northern Mariana Islands allow individuals to keep the amount of land necessary to support oneself. This means that if you can demonstrate the need for a certain amount of land to sustain your livelihood, you may be able to claim homestead protection in this territory.

Puerto Rico

In Puerto Rico, securing homestead protection requires a certified note from a notary public, which must be filed with the Land Registrar. This additional requirement ensures that individuals follow the proper procedures when applying for a homestead exemption in this territory.

By familiarizing yourself with the specific laws and regulations in US territories regarding homesteading, you can make informed decisions and navigate the homesteading process more effectively.

Homesteading and Bankruptcy

When considering bankruptcy, it is crucial to understand how homesteading exemptions can protect your home. Homestead exemption statutes vary by state, providing homeowners with the opportunity to safeguard at least a portion of their property’s value. This protection can have significant implications for both Chapter 7 liquidation bankruptcy and Chapter 13 repayment plans.

The majority of states offer some form of homestead exemption, allowing individuals to shield their personal residence from creditors. By taking advantage of these exemptions, you may be able to protect all or a portion of your home’s equity, reducing the amount you are required to repay during bankruptcy proceedings.

It’s important to familiarize yourself with the specific rules and exemptions related to homesteading in your state. By doing so, you can adequately protect your home and navigate the bankruptcy process with confidence.

“Homesteading exemptions provide individuals with the opportunity to protect their personal residence during bankruptcy proceedings, allowing them to keep their home or a significant portion of its equity. Understanding the rules and exemptions in your state is crucial for protecting your most valuable asset.”

By utilizing homesteading exemptions, you can preserve the value of your home and ensure that you have a foundation to rebuild your financial future. Consult with a bankruptcy attorney or legal professional to navigate the complexities of bankruptcy and take full advantage of homesteading protections.

For a visual representation of homesteading and bankruptcy, refer to the image below:

- Homesteading exemptions can provide protection for your home during bankruptcy.

- The majority of states have homestead exemption statutes.

- Understanding the rules and exemptions in your state is crucial.

- Homesteading exemptions can reduce the amount you are required to repay in bankruptcy.

- Consult with a bankruptcy attorney for guidance on utilizing homesteading protections.

Protecting Your Home in Bankruptcy

When filing for bankruptcy, protecting your home should be a top priority. By utilizing homesteading exemptions, you can safeguard your most valuable asset and ensure a stable foundation for your financial recovery. Understanding the rules and regulations in your state is key to successfully navigating bankruptcy proceedings while preserving your home.

Changes in Homestead Exemption Laws

Homestead exemption laws are not set in stone and can change over time due to regional and federal laws, as well as legal rulings. Staying up to date with these changes is crucial to ensure that you have accurate information and can make informed decisions regarding your homesteading plans. It is also essential to confirm the accuracy of any information you come across before relying on it.

Changes in homestead exemption laws can have significant impacts on your asset protection and your ability to qualify for homesteading exemptions. These changes can affect the amount of equity you can protect in your principal dwelling and the specific requirements you need to meet. By keeping yourself informed about the updates and changes in homestead exemption laws, you can adapt your strategies accordingly and safeguard your assets effectively.

Whether it’s modifications to the maximum exemption amounts, alterations to the qualifying criteria, or adjustments in the declaration processes, it is important to be aware of any changes that may affect your homesteading plans. These updates can vary from state to state, so it’s crucial to understand the specific laws in your jurisdiction.

Stay informed on changes in homestead exemption laws to protect your assets and ensure that you meet the necessary requirements for homesteading. The legal landscape can evolve, and being up to date can help you make better decisions and safeguard your future.

State Homesteading Guidelines

Each state has its own specific guidelines and regulations for homesteading. These guidelines outline the requirements, exemptions, and procedures for claiming a homestead exemption. It is important to familiarize yourself with the guidelines in your state to ensure compliance and proper asset protection.

In Alabama, for example, the homesteading guidelines state that only up to $15,000 of equity in a primary residence can be exempted. On the other hand, Florida offers unlimited homestead exemption, protecting an unlimited amount of equity in a primary residence from creditors.

“Knowing and understanding the state-specific homesteading guidelines is crucial for protecting your assets and determining the level of exemption you can claim. Lack of awareness can leave you vulnerable to potential losses.”

Some states have specific requirements regarding the size and type of property that qualifies for homesteading, while others may have no specific requirements at all. Additionally, some states may require you to live on the property for a certain period of time and make improvements to maintain the homestead exemption.

By carefully reviewing and adhering to the state homesteading guidelines, you can ensure that you meet all the necessary requirements and protect your assets effectively.

State-Specific Homesteading Regulations

State-specific homesteading regulations may vary in terms of the required documentation, filing procedures, and qualifying criteria. For example, Texas requires a declaration of homestead to be filed with the county clerk’s office to claim the homestead exemption, while California does not require a formal declaration but relies on automatic homestead protection.

- California: Automatic homestead protection without the need for a formal declaration.

- Texas: Requires a declaration of homestead to be filed with the county clerk’s office.

- Colorado: Homestead exemption requires the property to be the primary residence and occupied by the claimant.

It is crucial to familiarize yourself with these state-specific regulations to ensure compliance and make the most of the homesteading benefits available to you.

Homesteading Programs Across States

Homesteading programs can vary significantly across states, offering a range of support and resources to individuals interested in pursuing a homesteading lifestyle. While some states have well-established and comprehensive programs in place, others may have minimal or no programs available. It is crucial to research and understand the homesteading programs specific to your state to fully utilize the resources and support available.

State-specific homesteading programs can provide valuable guidance and assistance to individuals looking to establish and maintain their homestead. These programs may offer educational workshops, financial incentives, access to land and resources, and connections to communities and networks of like-minded individuals.

Benefits of Homesteading Programs

- Access to educational workshops and resources

- Financial incentives and grants for homesteading projects

- Land availability and lease programs

- Support networks and community connections

By participating in state-specific homesteading programs, you can gain valuable knowledge and skills necessary for successful homesteading. These programs can also provide opportunities to connect with other homesteaders, exchange ideas, and learn from experienced individuals in the field.

Homesteading program participants often develop a strong sense of community and mutual support, fostering a sustainable and resilient lifestyle.

Researching Homesteading Programs

When researching homesteading programs across states, consider the following:

- Check your state government’s official website for information on homesteading programs and resources.

- Reach out to local agricultural extension offices, county or city departments, or non-profit organizations that specialize in homesteading.

- Engage with online communities and forums to connect with homesteaders in your state who can provide firsthand information and guidance.

Gaining a thorough understanding of the specific homesteading programs available in your state will help you make informed decisions and take full advantage of the support and resources provided. Whether you are a beginner or an experienced homesteader, these programs can enhance your homesteading journey and contribute to your overall success.

Exploring State Homesteading Variations

When it comes to pursuing the homesteading lifestyle, it’s essential to understand the variations in state homesteading laws. Each state in the United States has its own unique set of laws and regulations that govern homesteading, offering different opportunities and challenges for those looking to embark on this path. By exploring these state homesteading variations, individuals can make informed decisions about where to pursue their homesteading dreams and how to navigate the different requirements and exemptions that exist.

By delving into the specifics of state homesteading laws, individuals can gain valuable insights into the intricacies of each state’s regulations. This knowledge empowers prospective homesteaders to understand the eligibility criteria, the size and type of properties that qualify for homesteading, and the specific duration and improvements required to maintain homestead status.

Furthermore, exploring state homesteading variations allows individuals to identify the states that offer the most favorable homesteading programs and resources. Some states have comprehensive programs in place that provide support and assistance to homesteaders, while others may offer limited or no programs. By understanding these variations, aspiring homesteaders can choose a state that aligns with their goals and provides the necessary resources to succeed.

FAQ

What is a homestead exemption?

A homestead exemption is a legal provision designed to protect the value in a principal dwelling place. It provides asset protection from creditors for at least some of the value in the homestead.

How do homestead exemption statutes vary by state?

Homestead exemption statutes vary by state, with some states offering 100% protection of equity, while others offer little to no protection. There are also variations in the requirements for married couples, the need for a declaration of homestead, and the option to choose between state and federal homestead exemption statutes.

What are the variations in homesteading requirements?

Homesteading requirements can vary significantly from state to state. Some states have specific requirements for the size and type of property that qualifies for homesteading, while others have no specific requirements. Additionally, some states require homesteaders to live on the property for a certain period of time and make improvements, while others have no such requirements.

How much homestead exemption can I claim?

Homestead exemption amounts vary by state. Some states have unlimited exemptions, while others have specific dollar amounts. The exemptions may also vary for married couples or joint owners.

Do US territories have variations in homesteading laws?

Yes, US territories also have variations in their homesteading laws. For example, American Samoa allows protection only for those of Samoan descent, while Northern Mariana Islands allows one to keep the amount of land needed to support oneself. Puerto Rico requires a note to be certified by a notary public and filed with the Land Registrar.

How do homesteading exemptions affect bankruptcy?

Homesteading exemptions are a significant consideration when contemplating bankruptcy. The majority of states allow some protection under their homestead exemption statutes, which can impact both Chapter 7 liquidation bankruptcy and Chapter 13 repayment plans.

Can homestead exemption laws change?

Yes, homestead exemption laws can change over time due to regional and federal laws and rulings. It is important to stay up to date with these changes and confirm the accuracy of information before relying on it.

What are state homesteading guidelines?

Each state has its own specific guidelines and regulations for homesteading. These guidelines outline the requirements, exemptions, and procedures for claiming a homestead exemption.

What homesteading programs are available across states?

Homesteading programs can vary across states, with some states offering comprehensive programs that provide support and resources to homesteaders, while others may have minimal or no programs in place. It is important to research and understand the homesteading programs available in your state to take full advantage of the resources and support available.

How can I explore state homesteading variations?

Exploring the variations in state homesteading laws can provide valuable insights into the different opportunities and challenges that exist across the United States. By understanding the specific laws and regulations in each state, individuals can make informed decisions about where to pursue homesteading and how to navigate the different requirements and exemptions.